Derivative trading comprises of trading steps or processes similar to stock trading on the stock exchange where investors place orders to buy or sell through brokers. These brokers are required to be member companies on the futures exchange. When an investor sends a buy/sell order through their broker, the broker will then send the order to the trading system of the futures market, prompting the futures contract trading exchange to act as a center matching buy/sell order using its electronic systems. Once buy/sell orders have been matched, details of such transaction will be sent to Thailand Clearing House (TCH) to perform a settlement. TCH is responsible for calculating the profits and losses that occur on a daily basis and overseeing payments and disbursements. This settlement occurs 1 day after an investor buys or sells on the futures market (T+1).

Derivatives services

What to know about margin requirements before you start investing

Those who wish to invest in futures contracts are required to set aside a specific amount of margins in their accounts in order to be eligible for investment. There are 3 types of margins:

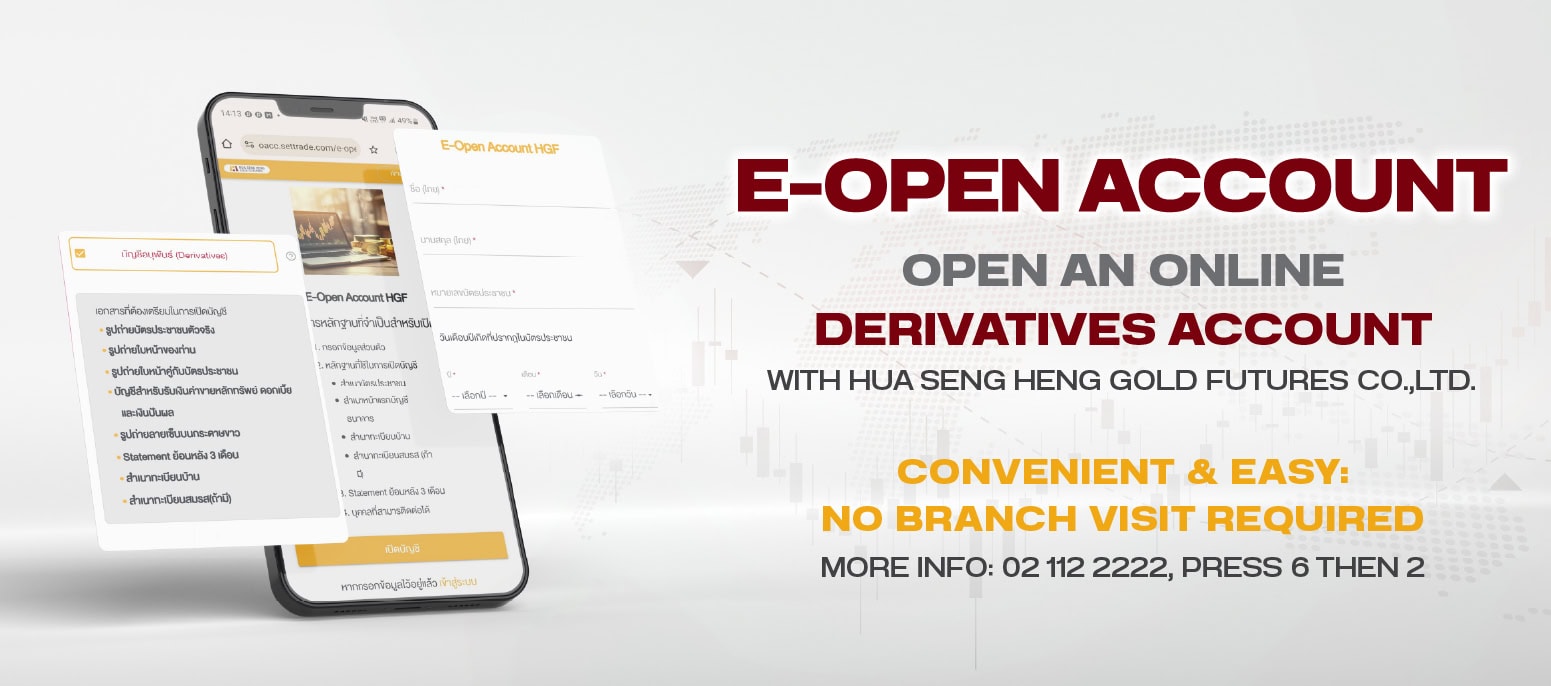

How to open a derivatives trading account

1 copy of your ID card

1 copy of your bankbook with account statements of the past 3 months

1 copy of your house registration document

Application form for an account and futures contracts

255 - 257, 2nd Floor, Yaowarat Road, Samphanthawong Subdistrict/District, Bangkok 10100

Tel: 02 112 2222, press 6

Business hours: Monday – Friday from 9:00 AM - 5:00 PM

For the security of the transaction:

Please ask for bank account numbers for payments and margins for futures

contracts from our staff at:

Tel. 02 112 2222 ext. 6

Download the Streaming application on App Store (iOS) and Google Play Store (Android).

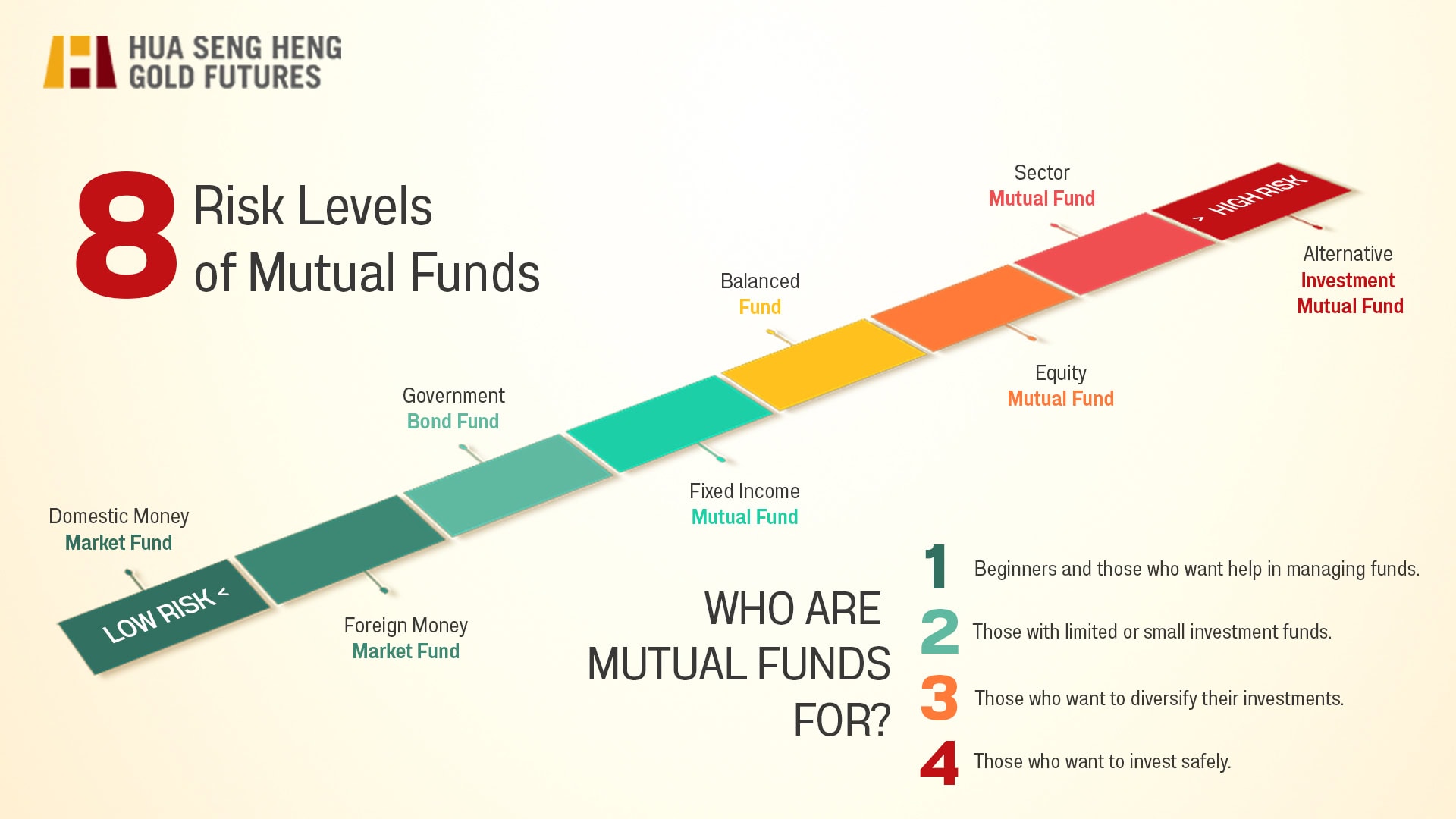

What are mutual funds?

A mutual fund pools funds from investors through unit trust purchases for the purposes of policy-based investment. A fund manager is an expert responsible for fund management and its growth, resulting in returns for investors.

There are a variety of investment policies in mutual funds, so you can choose your investment based on your preferred level of risk under the regulation of Securities and Exchange Commission (SEC).

Mutual fund advantages

- Funds managed by experts

- Ability to invest with relatively small amount of funds

- A variety of investment options

- High level of liquidity with the ability to sell unit trusts for cash when needed

- Secure investment under the oversight of SEC

- Investment diversification

- Tax reductions with mutual fund purchases